Cameroon to tax online gambling through money transfer levies in 2025 Finance Bill

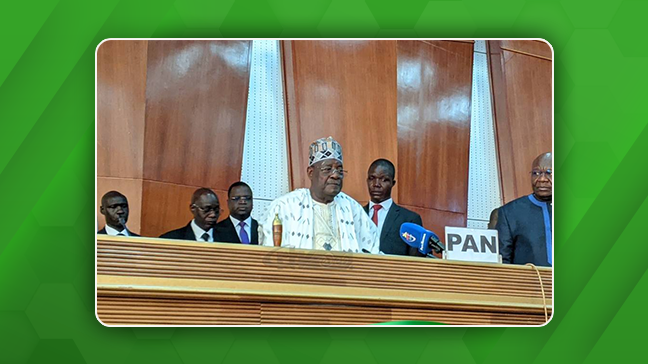

The National Assembly adopted Cameroon’s 2025 Finance Bill on December 8, with a balanced budget totaling 7.3177 trillion FCFA. According to News du Camer, as part of its strategy to diversify revenue and optimize tax collection, Cameroon plans to introduce a significant reform next year. This reform will involve taxing online gambling and entertainment activities under the existing money transfer tax framework introduced in 2022.

Chapter IV of the 2025 Finance Bill specifies that transactions on electronic gambling and entertainment platforms will be subject to a new tax rate of 1%, as opposed to the standard 0.2% applied to traditional money transfers. Additionally, every transaction, regardless of amount, will also include a fixed fee of 4 FCFA.

The new tax will expand on the money transfer tax introduced in January 2022, which previously only applied to electronic transfers, mobile money transactions, or cash withdrawals linked to these transfers. By extending this tax to online gambling, the government hopes to capture revenue from the booming sports betting and virtual casino industries. Financial Minister Louis Paul Motaze highlighted plans to implement new local tax obligations for gambling and entertainment licenses, with projections estimating 500 million FCFA in additional state revenue.

Share

-

Clover Treasure: Hold&Win a pot of gold ...Onlyplay proudly presents Clover Treasur...March 4, 2026

-

GoldenRace reinforces leadership in the ...GoldenRace, global leader in Virtual Spo...March 4, 2026

-

SBC Summit Malta Brings SEO Experts to T...SEO drives revenue, but AI and shifting ...March 4, 2026